St. Petersburg’s Housing Boom: Historical Parallels, Local Insights, and Future Outlook

The Current Housing Boom: A Closer Look

When we examine the present housing market, it’s tempting to draw comparisons to the infamous mid-2000s housing bubble. After all, the graphs depicting nominal house prices and price-to-rent ratios bear a striking resemblance to that tumultuous period. However, as we delve deeper, we’ll uncover significant distinctions that set our current situation apart.

Solid Lending Practices: A Key Differentiator

First and foremost, it’s crucial to recognize that lending practices today are vastly different from those of the mid-2000s. Back then, underwriting standards were practically non-existent, with loans being handed out like candy at a parade. In contrast, our current boom is built on a foundation of responsible lending, ensuring that homebuyers are truly qualified for their mortgages.

Demographic Tailwinds: The Millennial Factor

Moreover, the demographic landscape today is far more favorable than it was during the housing bubble. The largest generation in American history, millennials, are now entering their prime homebuying years. This demographic shift is creating a sustained demand for housing that simply didn’t exist in the mid-2000s.

A More Apt Comparison: 1978-1982

Given these fundamental differences, it’s more appropriate to compare our current situation to the period from 1978 to 1982. While no historical comparison is perfect, there are several striking similarities between these two eras that warrant our attention.

- Demographic Parallels

Just as the baby boomers were entering their first-time homebuying years in the late 1970s and early 1980s, we’re now seeing millennials take center stage in the housing market. This demographic surge is creating a robust demand for homes, much like we saw four decades ago.

- Rapid House Price Appreciation

In both periods, we’ve witnessed a significant acceleration in house prices. The pace of appreciation we’re seeing today is reminiscent of the rapid gains experienced in 1978, highlighting the intensity of the current market.

- Inflationary Pressures

Another similarity between these two eras is the presence of inflationary pressures. As prices rise across the board, it’s not surprising to see this reflected in the housing market as well.

- Federal Reserve Response

In response to inflationary concerns, the Federal Reserve has begun raising interest rates, much as it did in the late 1970s and early 1980s. This monetary tightening is aimed at cooling the economy and bringing inflation under control.

- Sharp Increases in House Payments

As a consequence of rising home prices and interest rates, we’re seeing a notable increase in monthly house payments. This echoes the experience of homebuyers in the 1978-1982 period, who also faced growing financial commitments.

St. Petersburg’s Housing Boom: How we compare.

Demographic Deep Dive: Understanding the Numbers

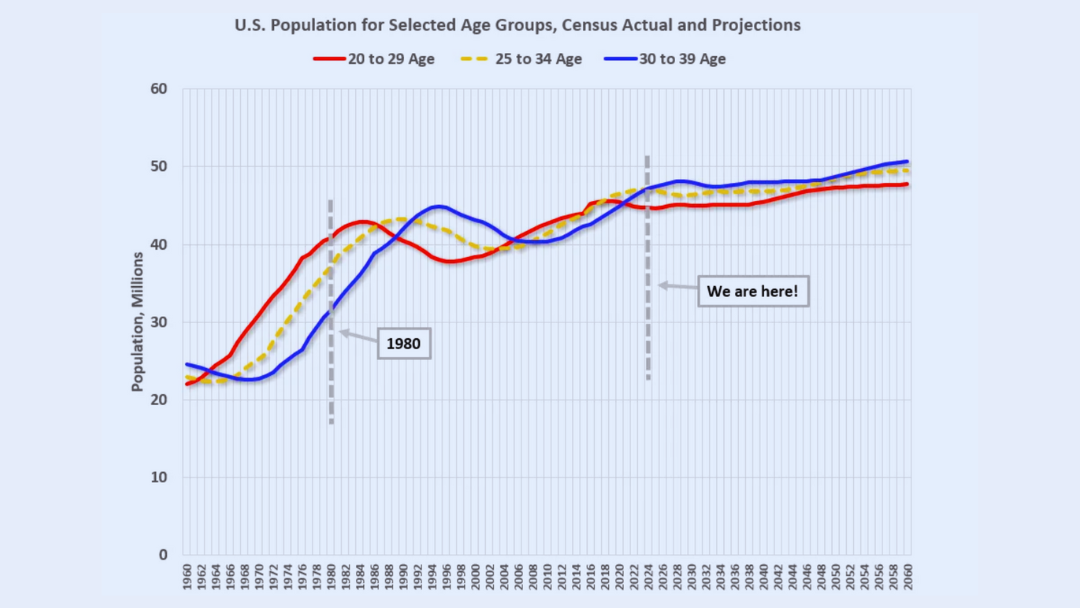

To fully appreciate the demographic forces at play, let’s examine the trends in key age groups over time. The Census Bureau provides us with data and projections from 1960 to 2060, allowing us to see the big picture.

The 20-29 Age Group: Apartment Demand Drivers

Over the past decade, we’ve seen a surge in the 20-29 age group. This increase led to a boom in apartment construction as young adults sought rental housing. However, this group peaked in 2018/2019 and is not expected to reach those levels again until the 2030s.

The 25-34 Age Group: Transitioning to Homeownership

The 25-34 age group, which often represents first-time homebuyers, is projected to peak around 2023. This suggests that we may see continued strong demand from this cohort in the near term.

The 30-39 Age Group: Prime Homebuying Years

Perhaps most significantly for the housing market, the 30-39 age group is currently increasing and is expected to continue growing throughout this decade. This demographic trend bodes well for sustained housing demand, as this age group often represents move-up buyers and those starting families.

Historical Context: 1978-1982 vs. Today

When we compare the current demographic landscape to that of 1978-1982, we see that the increase in the 30-39 age group was even more pronounced back then. This demographic tailwind helped support house prices during that period, much as we expect it to do in the coming years.

Rapid Price Appreciation: A Historical Perspective

It’s worth noting that the three periods of fastest house price appreciation over the last 50 years were 2021/2022, 1978, and the mid-2000s housing bubble. While the housing bubble stands out as an anomaly due to its unsustainable lending practices, the comparison between our current market and 1978 holds more water.

Looking Ahead: What This Means for House Prices

As we consider the implications of these trends for future house prices, it’s important to remember that while history can provide valuable insights, it doesn’t always repeat itself exactly. However, the similarities between our current market and the 1978-1982 period suggest that we may be in for a period of sustained housing demand and price stability, rather than a dramatic bust.

The solid lending practices of today, combined with favorable demographics and a growing economy, provide a strong foundation for the housing market. While we may see some moderation in price appreciation as interest rates rise and affordability becomes more challenging, the underlying demand for housing is likely to remain robust.

For potential homebuyers in the St. Petersburg area, this analysis suggests that while the market may be competitive, it’s built on more solid fundamentals than the mid-2000s bubble. As your realtor, I would advise that now may still be a good time to enter the market, particularly if you plan to stay in your home for the medium to long term.

For current homeowners, the outlook is generally positive. The strong demographic trends and limited housing supply in many areas suggest that your home’s value is likely to be supported in the coming years.

Local Market Insights: St. Petersburg’s Real Estate Landscape

To gain a more comprehensive understanding of how these national trends are playing out in our local market, I reached out to my colleagues at Avalon Group Realty. Their insights offer valuable context for anyone looking to buy or sell in the St. Petersburg area.

St. Petersburg’s Unique Appeal

Aaron Hunt, Broker of Avalon Group Realty, emphasizes the enduring allure of our city:

“St. Petersburg has always been a desirable location, but we’re seeing unprecedented interest from both local and out-of-state buyers. The combination of our beautiful beaches, vibrant cultural scene, and strong job market is drawing people from all over the country.”

This increased demand is putting pressure on our local housing inventory, contributing to the price appreciation we’ve been experiencing.

Inventory Challenges and Opportunities

Yvette Kim, another experienced Realtor with our team, points out the inventory situation:

“While we’re seeing strong demand, the supply of homes in St. Petersburg remains tight. This creates both challenges and opportunities for buyers and sellers alike. Buyers need to be prepared to move quickly when they find a home they love, while sellers are often receiving multiple offers.”

This dynamic underscores the importance of working with a knowledgeable local realtor who can help you navigate this competitive market.

The Impact of Remote Work

One factor that sets the current boom apart from previous periods is the rise of remote work. Aaron Hunt notes:

“The shift to remote work has been a game-changer for our market. We’re seeing an influx of buyers from larger, more expensive cities who can now work from anywhere. They’re drawn to St. Petersburg’s quality of life and relative affordability compared to places like New York or San Francisco.”

This trend is likely to continue influencing our local market even as some companies encourage a return to the office.

Generational Shifts in Homebuying

Yvette Kim has observed interesting patterns among different age groups:

“While millennials are certainly a driving force in our market, we’re also seeing active participation from Gen X move-up buyers and baby boomers looking to downsize. Each group has different priorities, which is creating diverse demand across various property types and neighborhoods.”

This multi-generational demand is contributing to the resilience of our local market.

Adapting to Rising Interest Rates

As interest rates climb, both buyers and sellers are having to adjust their strategies. Aaron Hunt offers this advice:

“Higher interest rates can be challenging for buyers, but they’re also helping to moderate price growth, which could create opportunities. We’re advising our clients to focus on the long-term benefits of homeownership rather than trying to time the market perfectly.”

Yvette Kim adds:

“For sellers, it’s crucial to price homes correctly in this changing environment. While the market is still strong, the days of extreme bidding wars may be behind us. We’re focusing on helping our clients present their homes in the best possible light to attract serious buyers.”

Looking Ahead: St. Petersburg’s Real Estate Future

Both Aaron and Yvette are optimistic about the future of St. Petersburg’s real estate market. Aaron Hunt concludes:

“While we may see some moderation in price growth, the fundamentals of our market remain strong. St. Petersburg’s appeal isn’t going away, and as long as we continue to attract new residents and businesses, the demand for housing will persist.”

Yvette Kim agrees, adding:

“For those considering entering the market, whether as buyers or sellers, now is an excellent time to start preparing. By working with a knowledgeable realtor and staying informed about market trends, you can make confident decisions regardless of market conditions.”

As we navigate this dynamic market, the insights from our experienced team at Avalon Group Realty can help you make informed decisions. Whether you’re a first-time homebuyer, looking to upgrade, or considering selling your property, we’re here to guide you through every step of the process in St. Petersburg’s exciting real estate landscape.

In conclusion, while it’s natural to be cautious given our collective memory of the housing bust, the current housing boom appears to be on much firmer footing. By understanding the historical context and the unique factors driving today’s market, we can make more informed decisions about buying, selling, or investing in real estate.

As always, we are here to help you navigate these market conditions and find the best opportunities in the St. Petersburg real estate market. Don’t hesitate to reach out if you have any questions or if you’re ready to make your next move in this dynamic housing landscape.

If you are looking for a St Petersburg Realtor visit https://avalongrouptampabay.com/